- The AI+

- Posts

- 📊How to Automate Variance Analysis in Excel Using ChatGPT (Step-by-Step)

📊How to Automate Variance Analysis in Excel Using ChatGPT (Step-by-Step)

Save Hours by Letting ChatGPT Handle Variance, Percentages, and Red Flags in Your Budget Reports

☕ Morning! Hope you have a great start of the week so far and we’re here to help you level up your Finance AI game.💪

Tired of copy-pasting, reformatting, and explaining formulas to coworkers who still use VLOOKUP? This week’s hack will save you hours in Excel. We listened to your feedback and break it down like ABC! 😃

We’re also decoding how the Fed “creates” money (hint: it's not a printer), and dropping tools that can help you summarize, automate, and work smarter — even during budget season.

Here’s what we have cooked up for you today:

⚡ 1 AI Hack Turn plain English into Excel magic using ChatGPT + Code Interpreter

🛠️ 3 Free AI Tools AI helpers for summarizing, automating tasks, and writing reports faster

📜 1 News Byte How the Fed Creates Money: A plain-English explainer + flowchart

And more…

Let’s go! 👇

⚡ 1 AI Hack: Automate Variance Analysis in Excel (with ChatGPT)

💬 Wait, ChatGPT Can Do Excel Work?

Yes — and it's kind of magical. You don’t need macros, VBA, or 10 years of spreadsheet wizardry.

With a simple copy/paste, ChatGPT can analyze your Excel data, summarize key insights, and even suggest follow-up actions — in seconds. It’s like having an intern who never sleeps (and never asks for coffee breaks).

📌 The Problem

You're reviewing a Budget vs Actuals report with 50+ line items. Your manager wants to know:

“What changed? What’s worth paying attention to? And what should we do about it?”

But you don’t have time to:

Manually calculate variance %

Color-code high-impact items

Write an insightful summary

Let AI handle the heavy lifting.

Here’s how to make your first automation happen:

🧰 What You’ll Need:

Excel (or Google Sheets)

👉 This sample template (attached at the end)

ChatGPT (or Claude, Gemini, Copilot — all work)

5 minutes or less ⏱️

🛠️ Step-by-Step Instructions (Beginner-Friendly):

1). Open the sample Excel template (attached at the bottom)

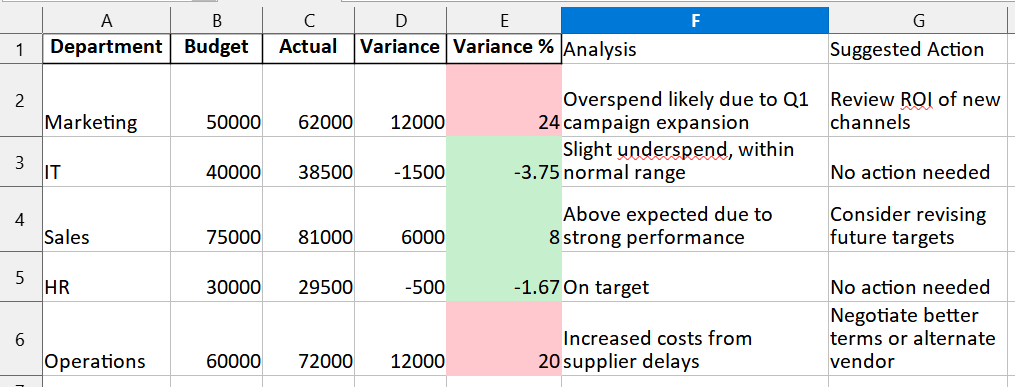

2). Select and copy this portion of the table:

Department | Budget | Actual

3). Open ChatGPT and paste this prompt:

You are a senior financial analyst. Here's a budget vs actual report for Q1. For each line item, calculate the variance (Actual - Budget), the variance %, and flag any items with a variance greater than ±10%. Provide a short explanation of possible causes and suggest one follow-up action per item.

[Paste your table here]

Return the result in a table format I can paste directly into Excel.

4). Copy the AI’s output back into Excel

Boom — you’ll get a clean, color-coded table with:

Variance math done

Explanations written

Suggested actions listed

✅ Try It Yourself

Use your own data or try the demo template attached at the end.

Then send the AI output straight to your boss (and take the credit 😎).

🔥Why This Is Awesome:

Saves you 30–60 mins of analysis

Works for any department or account or line of work (Finance, Accounting, Sales Ops etc.)

Looks proactive and polished in presentations

No Excel add-ins or formulas needed

Trains your prompt writing muscles 💪

🛠️ 3 Free AI Tools

🧰 1. Mindgrasp

What it does: AI-powered assistant for Excel — cleans messy data, generates formulas, builds charts, and calculates retention rates using natural‑language prompts.

Why it's helpful: One-stop solution for day-to-day spreadsheet headaches—no coding or complex setup needed

Link: https://excelmatic.ai

Pricing: Fully free plan with no signup required—great for quick analysis or cleanups.

🔄 2. GPTExcel

What it does: Chat-like tool that helps with formula generation (IF, VLOOKUP), folders data into tables, auto-generates charts, converts images to spreadsheets, and suggests insights on CSV/Excel files .

Why it's helpful: Ideal for Excel users wanting smart guidance—especially formula help and charting—without needing to write formulas manually.

Link: https://gptexcel.uk/

Pricing: Free to use; full access for formula/chat/chart features—no trial needed.

✍️ 3. Formulabot – Excel A

What it does: Quick “Excel AI chat” that auto-generates formulas, analyzes spreadsheets, and builds charts instantly .

Why it's helpful: No signup, no friction—paste data, ask questions like “create pivot-like summary,” and get instant formula/chart suggestions.

Pricing: Completely free for all basic features; no signup required.

Learn how to make AI work for you

AI won’t take your job, but a person using AI might. That’s why 1,000,000+ professionals read The Rundown AI – the free newsletter that keeps you updated on the latest AI news and teaches you how to use it in just 5 minutes a day.

🗞️ News Byte: The Fed Literally Makes Money 💵💻

🧠 Wait... the Fed just creates money?

Yep. And it’s not some TikTok conspiracy—it’s policy. Let's break it down 👇

🕰️ A (Very) Quick History of U.S. Central Banks etc.

1791 – First Bank of the U.S. is born. Congress kills it after 20 years.

1816 – Second Bank launches. Expired in 1836 after President Andrew Jackson shuts it down.

1836–1913 – No central bank for 77 years (yes, really).

1913 – Enter: Federal Reserve, the third central bank. Created under the Federal Reserve Act to manage the U.S. money supply, support financial stability, and issue our currency when Democrats controlled both Houses of Congress and the Presidency

1913 - 16th Amendment was ratified which gives Congress power to lay and collect direct taxes from the people (quite contrary to Article 1, Sec 9 which prohibits direct taxes)

Fun fact: The 12 regional Fed banks are technically private corporations under federal oversight. Quirky.

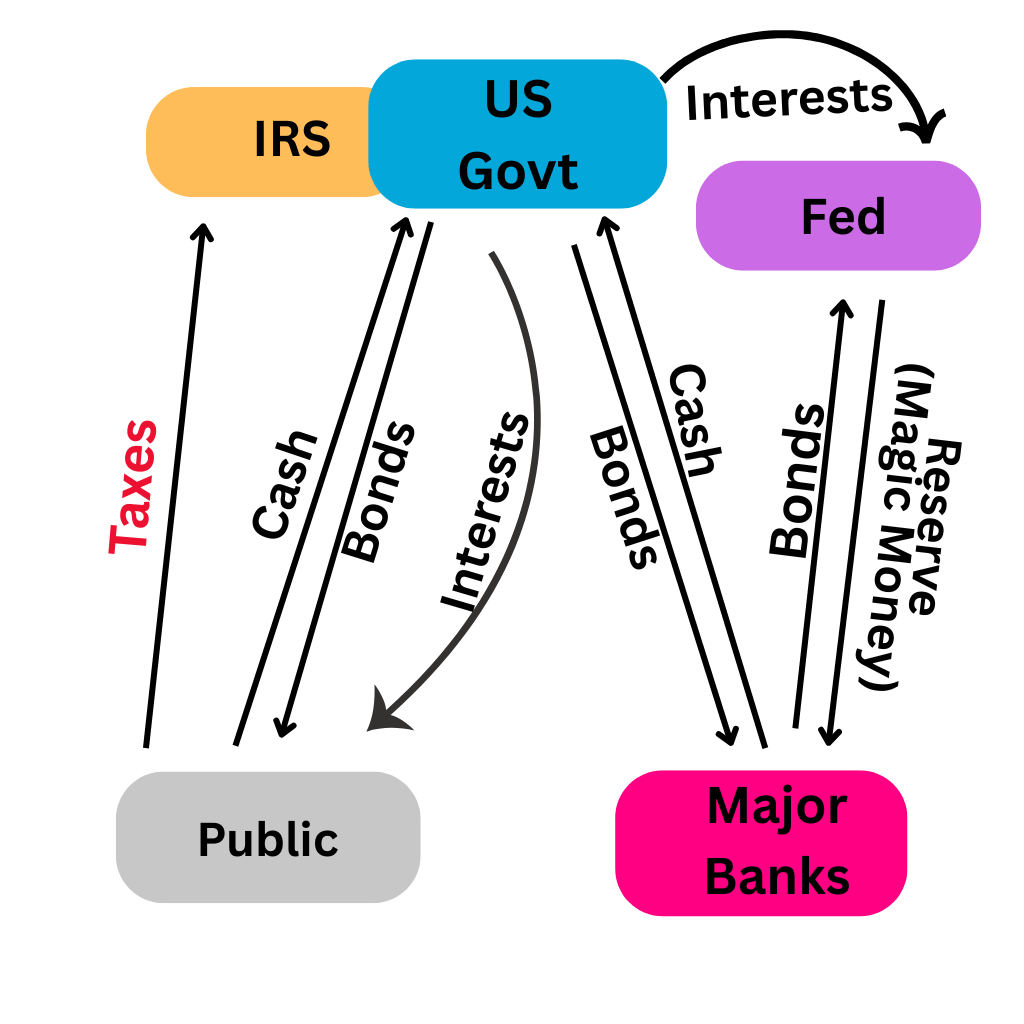

💸 How the Fed Actually Creates Money

Here’s the TL;DR:

Congress gave the Fed the power to create money from thin air. Literally.

It doesn’t print stacks of cash. It adds digits to reserve accounts of member banks such as JPMorgan—a digital money printer.

When it buys bonds (like U.S. Treasuries or mortgage-backed securities), it wires digital dollars into member bank accounts through “open market operations”.

This increases reserves, lowers interest rates, and encourages lending (a.k.a. the money multiplier effect).

If things get too hot (i.e. inflation), the Fed reverses course—selling assets to shrink the money supply.

💰 How the Fed Earns Money (Yes, It Makes a Profit… Sort Of)

Here's the Fed's basic business model:

It creates money digitally from thin air, no backing 👉️Fiat

It uses that money to buy interest-bearing assets (like U.S. Treasuries).

It earns interest income on those assets.

The difference between what it earns and what it pays (operating expenses, pay dividends/interests to member banks on reserves held, and maintain capital buffer) is profit, which normally gets sent to the U.S. Treasury.

But lately? Not so profitable. With higher interest rates, the Fed is paying more out than it’s earning—so it’s running losses. No Treasury remittances until the books balance out again.

💊 QE Explained (No Jargon, Just Juice)

You hear this a lot in the news especially during economic crisis but what is it really?

Quantitative Easing (QE) = the Fed buying lots of bonds using newly created money.

Why?

To boost the economy when interest rate cuts aren’t cutting it.

How it works:

The Fed creates digital money 💻💵

Buys bonds from major banks & funds

Banks now have more cash (more reserves) = cheaper loans = more spending

Goal: fight recessions, keep markets moving, avoid deflation

QE = 🚀 for credit and spending.

⚠️ Money Supply vs Inflation...

QE boosts the money supply. But inflation takes off if:

People & businesses spend the new money fast

The economy can’t keep up producing goods/services

Supply is limited but demand skyrockets = 💥 price increases

And remember: the U.S. dollar is fiat (not backed by gold or assets). So when too much money chases too few goods, the value of your dollars gets diluted. Value of money only increases when energy is expended i.e. increase in goods or services, NOT increase in money supply.

🔥Why It’s Matters:

QE isn’t just monetary theory - it shapes your forecasts, asset valuations, and even expense assumptions.

Understanding how the Fed operates helps you anticipate market shifts (rates, inflation, lending conditions)

In a world of fiat currency and digital money, financial literacy = strategic advantage.

It affects your personal finance too, think hedging against high inflation, protect your future with hard or alternative assets (gold, silver or Bitcoin)

📰 What’s Happening

📰 1. “Ted Cruz has a trillion‑dollar idea to reform the Fed”

Summary: Senator Cruz proposes ending interest payments on bank reserves—a move he claims could save the U.S. government $1 trillion over time. But analysts warn that such reforms could complicate monetary policy and weaken the Fed’s control over emergency liquidity .

Link: (Financial Times) – Smart read on reserve reform and fiscal impact

📰2. “Central banks can brush aside rising long bond yields”

Summary: This FT article examines why rising long-term bond yields in the U.S., UK, and Japan don’t necessarily threaten central bank credibility. It argues that current market moves are more fiscal than monetary—and that central banks should leave bond-market normalization to governments .

Link: (Financial Times) – Great context on bond yields vs. policy independence.

📰 3. “Letter: Questions need to be asked about the Federal Reserve's losses”

Summary: Alex Pollock (Mises Institute) raises alarms over the Fed’s $231 billion in operational losses as of May 2025, questioning its capital adequacy and urging Congress to reassess dividend policies .

Link: (Financial Times) – Bold critique worth noting for fiscal-watchers.

💡 Bonus

3 More Finance Tasks You Can Automate with example ChatGPT prompts.

1. 📈 Trend Spotting in Monthly Data

“Here are monthly expenses by department. Identify 3 key trends, unusual spikes, or consistent increases. Suggest possible causes and recommended next steps.”

[Paste: Department | Jan–Dec]

2. 💵 Cash Flow Categorization

“Categorize these transactions into Opex, Capex, or Other. Flag any items over $10K and suggest a cash flow improvement based on this list.”

[Paste: Date | Description | Amount]

3. 🧮 KPI Summary for Execs

“Here's our KPI report for the last 3 months. Summarize key wins, concerns, and where leadership should focus next.”

[Paste: KPI | Jan | Feb | Mar]

👉️ Want more AI hacks like this? Stick around for next week’s issue — we’re just getting warmed up 🔥

Meme Corner 😂

There you have it!

By now, you’ve:

✅ Turned boring Excel tasks into blazing-fast workflows with ChatGPT

✅ Discovered 3 tools to help you think less and do more

✅ Learned how the Fed buys bonds with digital cash it literally creates

✅ And hopefully chuckled at a meme that explains monetary policy better than Econ 101

Got ideas, feedback, request or a favorite AI prompt you’re using at work?

Hit reply — I read every response.

👉 Share the love + link: https://theaiplus.beehiiv.com/subscribe

Here’s your demo template for this week’s hack.

|

Until next week —

Stay curious, stay automating, and don’t let the macros win. 😄

Chief Nerd

Reply