- The AI+

- Posts

- 🧾 How Can I Use AI to Spot Fraud and Anomalies in Transactions?

🧾 How Can I Use AI to Spot Fraud and Anomalies in Transactions?

Audits don’t have to take days. This week’s AI+ shows you how to prompt ChatGPT to flag irregular transactions and surface fraud risks in seconds.

☕ Morning, finance fam!

Financial anomalies don’t wait—they hide. Miss one, and you're explaining discrepancies instead of educating clients.

What if AI could:

Highlight suspicious patterns in minutes, not days?

Pre-fill your audit checklist with flagged risks?

Save you both time—and the potential cringe when a client spot-checks a report?

You don’t need a forensic accounting team to do it either. This week, we show you how to use AI like a flashlight in your audit—finding what matters, fast.

Here’s what’s inside this week:

⚡ 1 AI Hack Prompt for anomaly detection in your transactions

🛠️ 3 Free Tools From ChatGPT hacks to anomaly-detection apps

🧠 1 News Byte One powerful story on how AI is already outpacing human audit filters—raw link included

📚What’s Happening 3 must-know developments with raw URLs

😂 Meme Corner: When AI calls out your “Big Latte Expense” in neon red

And more…

Let’s get to it: 👇

⚡1 AI Hack: Clean Up, Summarize, and Formula‑Generate—In One Prompt

🧠 The Problem:

Manual reviews miss subtle outliers—or drain your day. Transactions flagged late can spell client mistrust or even compliance headaches.

🧰 What You’ll Need:

ChatGPT (Free or Plus)

A CSV or list of recent transactions (redact sensitive info)

A prompt tuned for exceptions—not summaries

🪜 Step-by-Step Instructions:

🧾 Scenario:

You want to quickly surface oddities—large amounts, strange vendors, or unexpected frequencies.

✅ Step 1: Copy/paste sample transactions (CSV format)

Use a small slice of recent activity (10–30 rows). Keep the simple header:

Date, Payee, Amount, Category. See data dump below as example:

Date,Payee,Amount,Category 2025-07-02,Blue Harbor Cafe,12.50,Meals 2025-07-02,Blue Harbor Cafe,12.50,Meals 2025-07-03,Apex Office Supplies,124.99,Office Supplies 2025-07-03,Apex Office Supplies,1249.90,Office Supplies 2025-07-05,CryptoMax Exchange,3000.00,Investments 2025-07-06,Star Ride Car Service,842.20,Travel 2025-07-07,CoffeeCloud,12000.00,Meals 2025-07-08,Northwind Consulting,2500.00,Professional Fees 2025-07-08,Northwind Consulting,-2500.00,Refunds 2025-07-09,Cash Withdrawal,500.00,Miscellaneous 2025-07-10,Office Depot,62.41,Office Supplies 2025-07-10,Office Depot,62.41,Office Supplies 2025-07-11,Overseas Wire HK,4575.00,Miscellaneous 2025-07-12,Midnight Diner,58.20,Meals 2025-07-12,Midnight Diner,5820.00,Meals 2025-07-13,Gymflex Membership,120.00,Subscriptions 2025-07-14,Gift Cards R Us,800.00,Miscellaneous 2025-07-15,Parking Authority,25.00,Fees 2025-07-15,Parking Authority,25.00,Fees 2025-07-16,Apex Office Supplies,0.00,Office Supplies

✅ Step 2:

Use this prompt:

“Act like a forensic accountant. Analyze the following CSV of transactions (headers: Date, Payee, Amount, Category). Identify irregular transactions (outliers vs typical amounts, suspicious vendors, negative or zero amounts, duplicates, unusual frequency, or international wires). Return a table with: Date, Payee, Amount, Category, Flag Type, Why Flagged, First Check to Perform. Then list 3–5 suggested follow‑up actions.”

Paste the CSV right after the prompt.

✅ Step 3: Example output you should expect (from ChatGPT)

Date | Payee | Amount | Category | Flag Type | Why Flagged | First Check to Perform |

|---|---|---|---|---|---|---|

2025-07-02 | Blue Harbor Cafe | 12.50 | Meals | Duplicate | Two identical charges on same day | Confirm if one is a duplicate; request receipt |

2025-07-03 | Apex Office Supplies | 1249.90 | Office Supplies | Outlier (10×) | Amount ~10× larger than nearby purchase at same vendor | Verify invoice; confirm approval threshold |

2025-07-05 | CryptoMax Exchange | 3000.00 | Investments | Restricted/Risk | Crypto exchange; higher fraud/AML risk | Confirm policy allows crypto; source of funds |

2025-07-06 | Star Ride Car Service | 842.20 | Travel | Outlier | Unusually high car service vs typical local rides | Check trip details; receipt & purpose |

2025-07-07 | CoffeeCloud | 12000.00 | Meals | Extreme Outlier | Implausible “Meals” expense (likely miscoded or extra zeros) | Verify merchant category; correct coding |

2025-07-08 | Northwind Consulting | -2500.00 | Refunds | Negative Amount | Large refund; ensure it matches a prior charge | Tie to original invoice; confirm counterparty |

2025-07-09 | Cash Withdrawal | 500.00 | Miscellaneous | Cash Handling | Cash withdrawals raise control/receipt risks | Obtain receipt log; confirm petty cash policy |

2025-07-10 | Office Depot | 62.41 | Office Supplies | Duplicate | Two identical charges on same day | Confirm if one is duplicate or split tender |

2025-07-11 | Overseas Wire HK | 4575.00 | Miscellaneous | Intl Wire/AML | International wire; potential AML/compliance screening | Verify beneficiary; purpose; KYC/OFAC checks |

2025-07-12 | Midnight Diner | 5820.00 | Meals | Typo/Outlier | 5820.00 vs 58.20 same day/vendor suggests misplaced decimal | Request receipt; correct amount if error |

2025-07-16 | Apex Office Supplies | 0.00 | Office Supplies | Zero Amount | Zero‑amount entries can indicate voids/test items | Validate posting status; remove/adjust |

2025-07-14 | Gift Cards R Us | 800.00 | Miscellaneous | Gift Cards Risk | Gift cards commonly used to circumvent controls | Require approval trail; business justification |

Suggested follow‑ups (example):

Reconcile all duplicates (Blue Harbor Cafe, Office Depot, Parking Authority) against receipts; void or credit one if confirmed duplicate.

Validate outliers (CoffeeCloud $12,000; Apex 10×; Midnight Diner $5,820) against invoices; correct miscoding/decimal errors.

Run vendor concentration analysis (Apex, recurring meals) and set soft thresholds for alerts (e.g., >3× rolling median).

Enforce policy checks for crypto, gift cards, cash withdrawals, and international wires; document approvals and KYC steps.

Create an “exceptions” view in your accounting system/CRM and tag each item with owner + due date for resolution.

✅ Step 4: Batch actions in your workflow

Tag & assign: Add a “Flagged—Review” label and assign each item to an owner.

Timebox: 15–20 minutes to resolve duplicates and obvious entry errors first.

Escalate: Anything AML/policy‑sensitive (crypto, wires, gift cards) escalates to compliance.

💡 Pro Tip:

Save your prompt and the output table as a template. Next month, paste new CSV → compare flags month‑over‑month to show risk reduction in client reviews.

Want this kind of automation on demand? My personal GPT includes inbox prompts, triage workflows, and more.

🔗 Try it here: https://bit.ly/theaiplus_financegpt

🛠️ 3 Free AI Tools to Try This Week

🔍 ChatGPT (Free)

Use Case: Anomaly detection + suggested review steps

Tip: Use “act like a forensic accountant” for precise tone

📥 Mindbridge (free trial)

Use Case: Upload files for AI-powered risk scoring

Tip: Great for seeing what “looks weird” at a glance

⚙️ Perplexity.ai

Use Case: Ask “What stands out in these transactions?” and get context with sources

Tip: Good for audit footnotes or compliance backup

💡Bonus: Want ready-to-use prompts for audit anomaly detection, transaction triage, and compliance review?

Grab my $9 Prompt Pack for Advisers—plug it into your AI workflow and surface risks, not spreadsheets. https://bit.ly/smartmoneypromptpack

📰 News Byte: AI Is Outpacing Human Audit Filters — Already

Last week, the Wall Street Journal reported on IVIX, a New York–based startup that uses AI to uncover financial fraud across vast datasets—think offshore assets, layered laundering, and crypto networks. Their AI software identifies patterns invisible to traditional checks and flags anomalies that would take humans ages to catch.

In fact, the tool now helps investigators detect illicit activity in seconds—something auditors would spend days chasing. And with a fresh $60 million in Series B funding, IVIX is doubling down on expanding its capabilities to serve financial oversight agencies globally.

Why it matters: Your audit workflow can include this style of anomaly detection—if your AI prompt is sharp and your review smart. Instead of being reactive, you become preemptive.

📚 What’s Happening

📥 AI detecting patterns humans miss

New algorithms can flag suspicious behavior in real time—a game-changer for both audit efficiency and accuracy.

💡Internal audit meets AI-powered precision

Firms now use machine learning, NLP, and predictive analytics to broaden audit scope and reduce manual sampling.

https://www.plantemoran.com/explore-our-thinking/insight/2025/07/ai-and-internal-audit

AI fraud detection reaches ~91% of US banks

Most banks now lean on AI for fraud prevention—and nearly all anti-fraud pros plan to add GenAI capabilities in 2025.

https://www.elastic.co/blog/financial-services-ai-fraud-detection

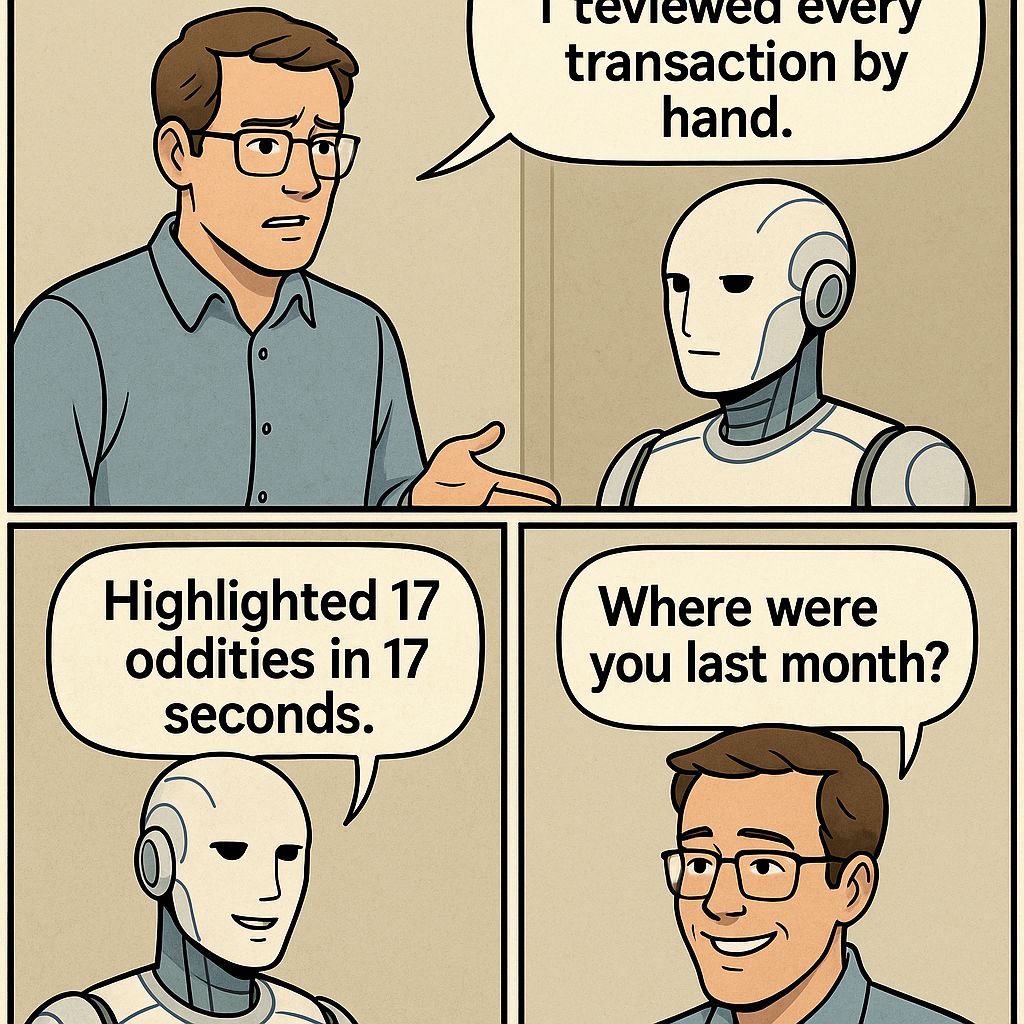

Meme Corner 😂

That’s a wrap, audit pro.

✅ You learned how to prompt ChatGPT to detect irregularities

✅ Tested tools that score risks and flag anomalies instantly

✅ Saw how AI reduces audit time from days to minutes

Audits → faster, sharper, smarter.

Requests, ideas or prompts, hit reply or comment and let me know - I read every response/comments.

Know an auditor who needs help? Share this issue → https://theaiplus.beehiiv.com/subscribe

Until next time,

Audit smarter, flag faster, and let AI handle the heavy scanning. 😎

Shirley, Chief Nerd at The AI+

Reply