- The AI+

- Posts

- 🧾 How to Use AI to Cut Tax Prep Time in Half (Without Losing Billable Hours)

🧾 How to Use AI to Cut Tax Prep Time in Half (Without Losing Billable Hours)

Delegate the grunt work — data sorting, doc requests, follow-up emails — and stay focused on strategy and client value

☕ Morning, finance fam!

Tax pros are about to get their time back. We’re not forgetting you!! 😀

From client intake and doc summaries to follow-up emails and prep checklists, AI is surprisingly good at handling the repetitive tasks that slow you down.

This week, we’re showing how to use your AI assistant to take the pressure off — without dropping billable hours or deliverables.

Here’s what’s inside this week:

⚡ 1 AI Hack Summarize tax docs and prep notes with one simple prompt

🛠️ 3 Free Tools AI helpers for tax pros that speed up your day

🧠 1 News Byte Why AI’s role in tax prep is about to scale

📚What’s Happening Prompts, checklists, and automation ideas

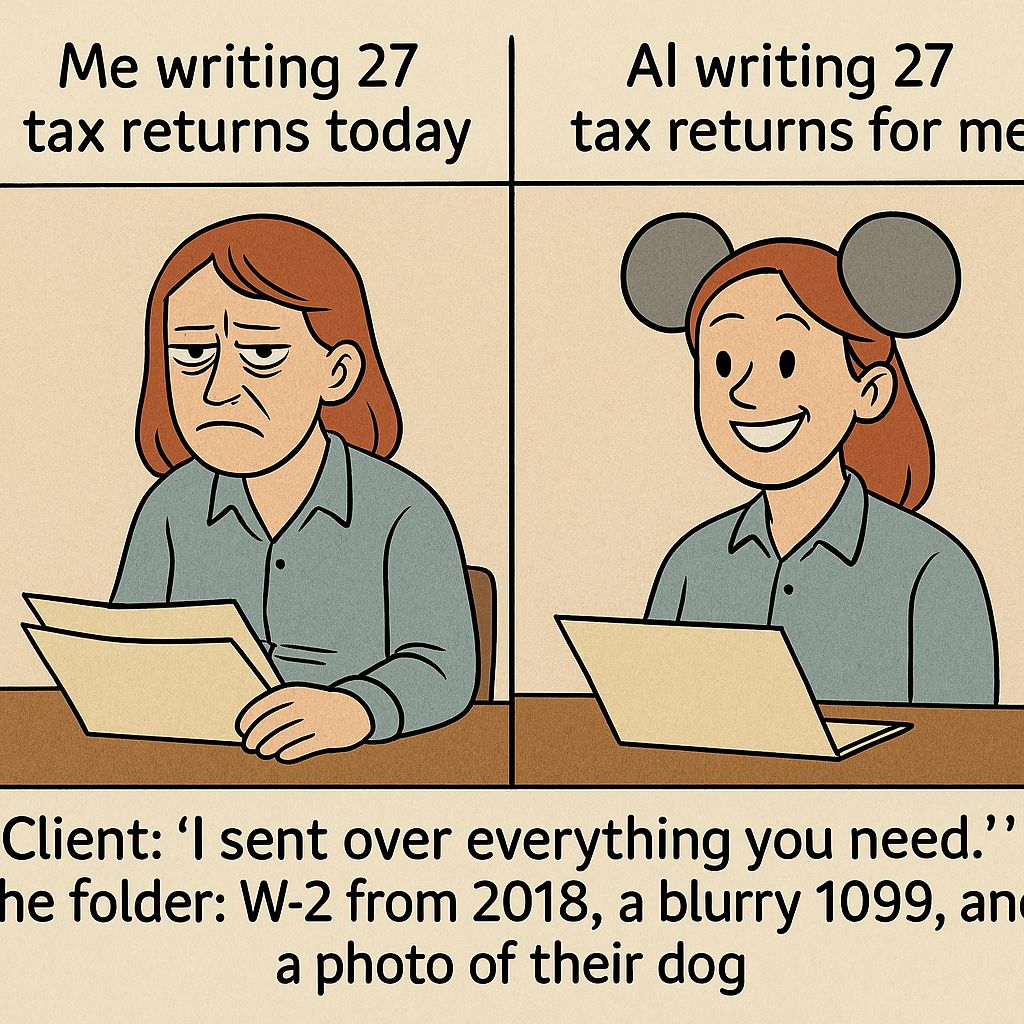

😂 Meme Corner: Every tax pro’s face during document season

And more…

Let’s get back your valuable time — the smart way 👇

⚡1 AI Hack: Summarize Tax Docs Automatically

🧠 The Problem:

You’re spending way too much time reviewing tax docs before you can even start filing.

Clients send messy PDFs, disorganized Dropbox folders, and vague Google Sheets. It’s exhausting just figuring out what’s useful.

⚡The Hack:

Use ChatGPT to scan → summarize → flag.

You feed it a tax doc or messy notes.

It gives you:

Key numbers

Flagged issues

Bullet summary

🧰 What You’ll Need:

ChatGPT (free version works)

Any client-supplied document (PDF, email text, CSV, etc.)

5 minutes and a sharp prompt

🪜 Step-by-Step Instructions: Extract What Matters — Fast

🧾 Scenario:

A client sends a PDF dump of their 1099s, W-2s, and brokerage statements. You need a quick summary to start prep.

✅ Step 1: Feed your pdf into ChatGPT

Prompt:

“You’re a tax professional. Read the content below and summarize it into key categories: income types, major deductions, and follow-up items I should ask the client. Use bullet points.”

Paste or upload doc text.

🖊️ Example Output:

Income:

W-2: $86,000 (ACME Corp)

1099-NEC: $12,400 (consulting)

1099-B: $2,500 short-term gain

Potential Deductions:

$1,500 home office

$2,800 vehicle mileage

$300 charitable donations

Missing/Needs Follow-Up:

1099-R not included

No documentation for vehicle expenses

Self-employed health insurance not listed

✅ Step 2: Copy and paste data to your workpapers

✅ Step 3: Build your own reusable template

Prompt Template:

“You’re a tax professional. Read the content below and summarize it into key categories: [category1] , [category2], [category3] and follow-up items I should ask the client. Use bullet points.”

💡 Pro Tips:

Use this same prompt for:

Client questionnaires

Annual checklists

Email summaries before kickoff calls

Less time scanning docs. More time advising.

💡 Bonus prompt:

“Read this tax document. Pull out key financials, deductions, income sources, and any issues needing follow-up. Bullet format.”

(Upload PDF or paste text)

Turn AI into Your Income Engine

Ready to transform artificial intelligence from a buzzword into your personal revenue generator

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

🛠️ 3 Free AI Tools to Try This Week

🧾 ChatGPT (Free)

Use Case: Summarize, sort, and organize raw client doc text

Tip: Add “act like a tax pro” to improve relevance

Use Case: Upload and query full PDF files like tax returns or statements

Tip: Ask “What’s missing for tax prep?” and it will scan for gaps

📤 TaxDome AI Assistant

Use Case: Categorizes and summarizes client-uploaded tax documents

Tip: Use it for onboarding new clients or post-intake organization

📰 News Byte: AI’s Role in Complex Tax Decisions (The Tax Adviser)

John Sapp, CPA and veteran at Drake Software, shares a measured view of AI’s place in tax preparation:

Small starts, big potential: Many tax pros begin using AI for email drafting and client letters—“a good entry point”—before scaling up to complex tasks like Excel modelling.

Excel powers: AI helps generate and troubleshoot formulas instantly and structure large datasets, boosting accuracy and speed.

Cautious approach: Sapp emphasizes the SPAR framework—Cite sources, Prioritize privacy, Verify accuracy, and Check reliability—when using public AI tools to avoid risks ﹣ especially regarding prompt hygiene and client confidentiality.

Human value remains irreplaceable: He firmly states that AI cannot build trust, interpret nuance, or understand emotional context—making tax professionals essential for complex client relationships.

Why it matters: This article validates starting small and staying cautious. AI can accelerate certain workflows—but without strict vetting and privacy safeguards, mistakes or misuse will undermine trust and compliance.

📚 What’s Happening

Tax Firms Falling Behind If They Don’t Act Now

A Thomson Reuters–backed study shows firms with AI strategies are achieving 3.1× ROI versus non‑adopters (86% vs. 28%).

“Firms that don’t develop AI strategies… risk falling seriously behind.”

CPA.com Releases 2025 AI in Accounting Report

New research from AICPA and CPA.com reveals that over 70% of accounting professionals now see Generative AI as strategic, while 89% say it can be applied to their work. But only 20% are measuring ROI—suggesting widespread adoption without clear tracking

https://www.cpa.com/news/cpacom-issues-2025-ai-accounting-report

RSM Commits $1 Billion to AI for Tax & Audit

RSM US plans to invest heavily in generative AI to power internal workflows and client services. Tools like RSM Atlas help automate compliance checks with up to 80% efficiency gains.

https://www.wsj.com/articles/rsm-plans-1-billion-investment-in-ai-agents-other-services-8b9e7bce

Meme Corner 😂

That’s a wrap!

✅ You learned how to use AI to summarize messy tax docs

✅ Got 3 tools to save hours this season

✅ Peeked into the future of AI-powered tax prep

Requests, ideas or prompts, hit reply or comment and let me know - I read every response/comments.

👉 Know another tax pro who needs this? Share this issue: https://theaiplus.beehiiv.com/subscribe

Until then -

Stay focused, stay fast, and let AI do the first read. 😎

Shirley, Chief Nerd at The AI+

✨ PS: I built a prompt pack for people who want to fix their finances using AI.

100+ ready-to-use ChatGPT prompts for budgeting, investing, and earning more — even with a busy schedule.

Reply